Financial Planning

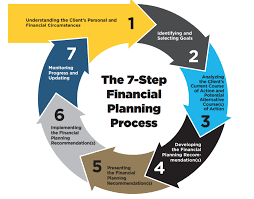

At Kellman Barnes Financial Planning, we use the CFP® Board's seven step financial planning process to bring all the pieces of your financial life together. If you:

- Want to better manage your finances, but aren't sure where to start

- Don't have time to do your own financial planning

- Want a financial advisor's opinion about the plan you've developed

- Don't have sufficient expertise in certain areas such as investments, insurance, taxes or retirement planning

- Have an immediate need or unexpected life event

you might benefit from going through the financial planning process. Our CERTIFIED FINANCIAL PLANNER™ professionals are here to walk you through the seven-step process.

Our fee for financial planning is $200 an hour. During step one of the process your planner will estimate the hours it will take to complete your financial plan. 50% of the estimated fee is collected up front and the remainder is collected after your plan has been presented.

This fee is waived for our investment advisory clients that meet certain qualifications.

PRE-RETIREMENT SAMPLE FINANCIAL PLAN

POST-RETIREMENT SAMPLE FINANCIAL PLAN

Investment Planning

If you no longer wish to manage your investments alone, you can hire us to be your investment advisor. A Kellman Barnes Financial Planner will work with you to understand your goals, risk tolerance, time frame and tax bracket and help you develop an appropriate investment policy.

Your investments will be held safely at BNY Mellon Pershing. Your investment advisor representative will enter into a signed contract with you that holds their investment advice to a fiduciary standard.

We use low cost exchange traded funds (ETFs) and non-commission mutual funds to diversify your portfolio to attempt to achieve as much return as possible for you based on your risk tolerance.*

We don't charge commissions and we don't get paid more for recommending one investment over another. You pay a flat fee based on a percentage of your assets under management. This is an annual fee that is deducted quarterly from your account.

Investment Advisory Fee Schedule

- Account balances less than $250,000 your advisory fee is 1.25% a year

- $250,000 and $500,000 your advisory fee is 1.1% a year

- $500,000 to $1,000,000 your advisory fee is 1% a year

- $1,000,000 to $2,000,000 your advisory fee 0.95% a year

- $2,000,000 to $3,000,000 your advisory fee is 0.9% a year

For those with advisory accounts above $500,000, the financial planning fee is waived.

Non-Advisory Services

Where appropriate and called for Kellman Barnes Financial Planning is licensed to offer commissionable securities and insurance products such as annuities, life, disability and long-term care insurance.

*Diversification is an approach to help manage investment risk. It does not eliminate the risk of loss if secuÂÂrity prices decline.